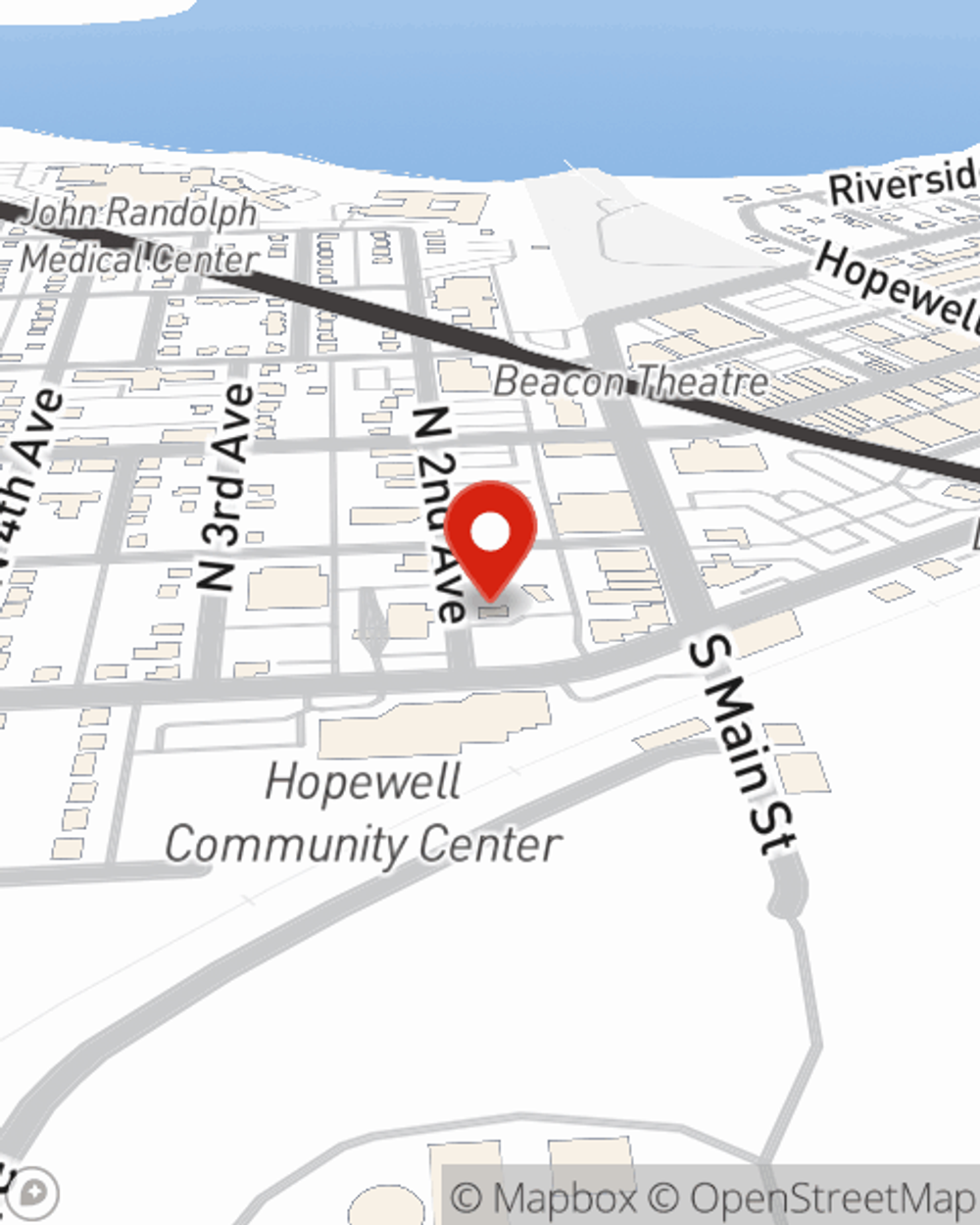

Business Insurance in and around Hopewell

Calling all small business owners of Hopewell!

Insure your business, intentionally

- Hopewell

- Colonial Heights

- Petersburg

- Prince George

- Chester

- Fort Lee

This Coverage Is Worth It.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Problems happen, like an employee gets hurt on your property.

Calling all small business owners of Hopewell!

Insure your business, intentionally

Insurance Designed For Small Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent George Diradour is ready to help you prepare for potential mishaps with reliable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, George Diradour can help you file your claim. Keep your business protected and growing strong with State Farm!

Eager to research the specific options that may be right for you and your small business? Simply contact State Farm agent George Diradour today!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

George Diradour

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.